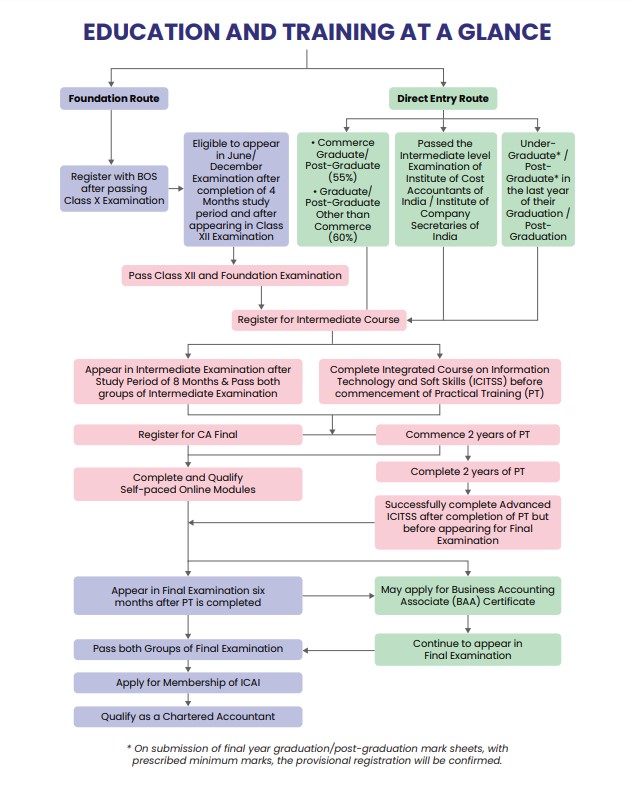

ICAI proposed CA New Scheme of Education and Training

The Institute of Chartered Accountants of India (ICAI) has recently put forth a progressive and comprehensive scheme aimed at enhancing the education and training process for chartered accountants (CAs). The new scheme, which is called as Chartered Accountants(amendments) Regulations 2023, aims to make the CA qualification more relevant to the needs of the 21st century workplace.

The new scheme is a significant change from the current system. The changes proposed in the new scheme are designed to make the CA qualification more accessible to students, more relevant to the needs of the workplace, and more rigorous. An ICAI detailed ppt on the new scheme has been uploaded on website as well to inform about the changes.

CA course duration under the new scheme

The CA Course duration under the new scheme is 42 months. This is a reduction of 6 months from the current duration of 48 months. The reduction in duration is due to the following factors:

- Reduction in the number of exams: The number of exams required to become a CA will be reduced from 10 to 6. This will make the CA qualification more accessible to students and reduce the overall time required to complete the course.

- Reduction in the duration of the articleship training: The duration of the articleship training program will be reduced from 3 years to 2 years. This will make the articleship training program more flexible and allow students to enter the workforce sooner.

- Introduction of self-paced modules: A set of self-paced modules will be developed to cover the subjects that are not covered in the exams. These modules will be available online and will be mandatory for all CA students. This will allow students to learn at their own pace and in their own time.

The new CA Course duration is a significant change from the current system. The changes proposed in the new course are designed to make the CA qualification more accessible to students, more relevant to the needs of the workplace, and more rigorous.

Here is a table that summarizes the changes proposed in the CA Course duration under the new scheme:

| Course level | Current CA Course Duration | Proposed CA Course Duration |

|---|---|---|

| Foundation study period | 4 Month | 4 Month |

| Intermediate study period | 8 Month | 8 Month |

| Articleship period | 3 Year | 2 Year |

| Final study period | NA | 6 Month |

| Total time period | 48 months | 42 months |

| CoP work ex | NA | 1 Year |

The new CA Course duration is a significant change from the current system.

Changes to the Foundation Course

The following are the changes proposed in the CA Foundation course under the new scheme:

- Current system:

- The CA Foundation course does not impose any restrictions on the number of attempts allowed.

- Students can give any number of attempts.

- Moreover, the registration validity for CA Foundation can be revalidated multiple times as well.

- Proposed scheme:

- Under the proposed scheme, students have the opportunity to register for the CA Foundation course after completing their 10th standard, with the registration remaining valid for a duration of four years

- However, once the four-year period is over, students will not be able to revalidate their foundation registration any further.

- Additionally, the proposed scheme eliminates the need for specific cut-off dates like January 1 and July 1 for CA Foundation registration, allowing greater flexibility for students.

- As a result, the Institute of Chartered Accountants of India (ICAI) will be able to conduct three exams per year, leading to increased opportunities for aspiring CAs to complete their foundation level.

In the current system of CA Foundation, students can give any number of attempts and can revalidate their registration multiple times.

The proposed scheme is more stringent. Students will have to complete the CA Foundation course within four years, and they will not be able to revalidate their registration after that. This will ensure that students are more focused and motivated to complete the course on time.

The removal of cut-off dates will also be beneficial for students. It will allow them to register for the CA Foundation exam at any time of the year, which will be more convenient for them. It will also enable the ICAI to conduct three exams in a year, which will help to reduce the waiting time for students.

Overall, the proposed scheme of CA Foundation registration is a more stringent and efficient system. It will help to ensure that students complete the course on time and that the ICAI is able to conduct more exams in a year.

- The CA Foundation syllabus has been revised by the Institute of Chartered Accountants of India (ICAI). The new syllabus, which will be proposed from 2024, will have four papers instead of six, and will remove two subjects: Business Correspondence & Reporting and Business & Commercial Knowledge.

The new syllabus will be as follows:

- Paper 1: Accounting (100 marks)

- Paper 2: Business Laws (100 marks)

- Paper 3: Quantitative Aptitude (100 marks)

- Paper 4: Business Economics (100 marks)

The subjects of Business Mathematics, Logical Reasoning, and Statistics will be covered in the Quantitative Aptitude paper.

The removal of Business Correspondence & Reporting and Business & Commercial Knowledge is in line with the ICAI's goal of making the CA Foundation syllabus more relevant to the needs of the 21st century workplace. These two subjects were considered to be less relevant to the needs of today's accountants, and their removal will allow the ICAI to focus on the more important subjects.

The new syllabus is expected to be more challenging than the current syllabus, but it is also expected to be more relevant to the needs of the 21st century workplace. Students who are planning to pursue a career in accounting should be prepared for the challenges of the new syllabus, but they should also be confident that they will be well-prepared for the demands of the workplace.

Here are some of the benefits of the new CA Foundation syllabus:

- It is more challenging, which will better prepare students for the demands of the CA profession.

- It is more focused on the core subjects of accounting, business laws, and quantitative aptitude.

Overall, the new CA Foundation syllabus is a positive development.

- The Institute of Chartered Accountants of India (ICAI) has made some changes to the CA Foundation exam pattern. In the new scheme, students will have to get 50% marks to pass the exam, and there will be a negative marking of 0.25 for every wrong multiple-choice question (MCQ) answer.

The current exam pattern for the CA Foundation course is a combination of subjective and objective questions. The new exam pattern will be objective only, with negative marking for wrong answers.

The introduction of negative marking is a significant change from the current system. It will make the exam more challenging, as students will have to be more careful about answering the MCQs correctly. However, it will also help to ensure that only the most qualified students pass the exam.

The increase in the pass mark to 50% is also a significant change. It will make it more difficult for students to pass the exam, but it will also ensure that only the students who have a good understanding of the subject matter will be able to pass.

The changes to the CA Foundation exam pattern are designed to make the exam more challenging and to ensure that only the most qualified students pass. These changes are a positive development, as they will help to improve the quality of the CA qualification.

Here is a table that summarizes the changes to the CA Foundation exam pattern:

| Current Exam Pattern | Proposed Exam Pattern |

|---|---|

| Subjective and objective questions | Objective only, with negative marking (0.25) |

| Pass mark of 35% | Pass mark of 50% |

Changes to the Intermediate Course

-

The validity of the CA Intermediate registration has been increased from 4 years to 5 years. This means that students who have registered for the CA Intermediate course will now have 5 years to complete the course.

Previously, students who had registered for the CA Intermediate course had to complete the course within 4 years. If they did not complete the course within 4 years, they had to re-register for the course and pay the registration fees again.

The increase in the validity of the CA Intermediate registration is a welcome change. It will give students more time to complete the course, and it will also save them the cost of re-registering for the course.

However, it is important to note that students can only revalidate their CA Intermediate registration form once. This means that if a student fails to complete the course within 5 years, they will not be able to re-register for the course again. -

The Institute of Chartered Accountants of India (ICAI) has proposed a number of changes to the CA Intermediate course. These changes include:

- Reducing the number of papers from 8 to 6.

- Merging Papers 1 and 5 into one paper called Advanced Accounting.

- Removing Enterprise Information Systems from Paper 7 and Economics for Finance from Paper 8. The remaining parts of these two papers will be merged into Paper 6, which will be called Financial Management and Strategic Management.

- Renaming Paper 2 of Corporate Law to Companies Act and making it cover the entire Companies Act. The portion of Business Law that was covered in Paper 2 will be moved to the CA Foundation course.

- Dividing the CA Intermediate course into two groups of 3 papers each.

The changes to the CA Intermediate course are designed to make the course more relevant to the needs of the 21st century workplace. The reduction in the number of papers will make the course more manageable for students, and the merging of some of the papers will make the course more coherent. The removal of Enterprise Information Systems and Economics for Finance is in line with the ICAI's goal of making the course more focused on the core subjects of accounting, finance, and law. The renaming of Paper 2 of Corporate Law to Companies Act and making it cover the entire Companies Act is a positive development, as it will ensure that students are well-prepared for the demands of the workplace.

The division of the CA Intermediate course into two groups of 3 papers each is a significant change. It will allow students to take the papers in their preferred order, and it will also allow students to focus on one group of papers at a time.

Overall, the changes to the CA Intermediate course are a positive development. They are designed to make the course more relevant to the needs of the 21st century workplace, and they will make the course more manageable for students.

Here is a table that summarizes the changes to the CA Intermediate course:

| Current CA Intermediate Course | Proposed CA Intermediate Course |

|---|---|

| 8 papers | 6 papers |

| Papers 1 and 5 are merged into one paper called Advanced Accounting | Enterprise Information Systems and Economics for Finance are removed from the course |

| Paper 2 of Corporate Law is renamed to Companies Act and covers the entire Companies Act | The portion of Business Law that was covered in Paper 2 is moved to the CA Foundation course |

| The course is divided into two groups of 3 papers each |

- The passing criteria for the CA Intermediate exams will also change. There will be 30% MCQ-based questions in all 6 papers. Furthermore, there will be negative marking of 0.25 for every wrong answer.

- The Institute of Chartered Accountants of India (ICAI) has introduced a new scheme for the CA Intermediate exams, whereby students can benefit from permanent exemptions in specific papers. According to the proposed scheme, if a student achieves an exemption in any paper, that exemption will be retained permanently for that particular paper. This means that the ICAI will treat the exempted paper as permanently passed. However, the student will still need to clear the rest of the papers with 50% marks in order to pass the CA Intermediate exams.

The current passing criteria for the CA Intermediate exams is 50% in aggregate. This means that students must score at least 50% in each paper in order to pass. The introduction of negative marking will make it more difficult for students to pass the exam, as they will have to be more careful about answering the MCQs correctly. However, it will also help to ensure that only the most qualified students pass the exam.

The increase in the number of MCQs in the CA Intermediate exams is also a significant change. It will make the exam more challenging, as students will have to be more familiar with the concepts in order to answer the MCQs correctly. However, it will also help to ensure that only the students who have a good understanding of the subject matter will be able to pass the exam.

The changes to the passing criteria for the CA Intermediate exams are designed to make the exam more challenging and to ensure that only the most qualified students pass. These changes are a positive development, as they will help to improve the quality of the CA qualification.

The new exemption rule is a positive development. It will allow students to focus on the papers that they are struggling with, and it will also allow students to save time and money.

Here is an example of how the new exemption rule will work:

- A student takes the CA Intermediate exams and passes 3 papers.

- The student fails in 2 papers, but gets an exemption in 1 paper

- The student will need to retake the 2 failed papers, but they will not need to retake the exempted paper.

The new exemption rule is a welcome change. It will make the CA Intermediate exams more flexible and it will also make it easier for students to pass the exams.

Changes in Articleship

1. The Institute of Chartered Accountants of India (ICAI) has reduced the CA articleship duration from 3 years to 2 years. This is a welcome change for CA aspirants, as they can now become CAs earlier than before.However, there is a condition for aspirants who want to become practitioners. They must have 1 year of experience in a Chartered Accountancy firm after completing their articleship. Once they have this experience, they will be eligible to receive a certificate of practice.

As per the new scheme introduced by the Institute of Chartered Accountants of India (ICAI), existing CAs will have a streamlined condition for fulfilment if they have completed a minimum of one year of work experience in a CA firm within the past five years. This provision allows these CAs to meet the required condition for their professional experience. This condition does not apply to aspirants who want to do a job.

In addition, students can undergo industrial training for nine months to 1 year in the last 1 year of their articleship. This will help them gain practical experience and prepare for their future careers.

Overall, the changes to the CA articleship period are a positive development. They will allow CA aspirants to become CAs earlier than before, and they will also help them gain the practical experience they need to succeed in their careers.

Here are some of the benefits of the reduced CA articleship period:

- CA aspirants can become CAs earlier than before.

- CA aspirants can save time and money.

- CA aspirants can gain more practical experience.

2. The Institute of Chartered Accountants of India (ICAI) has introduced a new scheme for the CA Intermediate exams. Under the new scheme, students will have to clear both the groups of CA Intermediate and complete the ICITSS training in order to be eligible to start the articleship training.

This is a positive development for students, as it will allow them to focus entirely on the practical training and not have to worry about exam preparation. The articleship training is a valuable opportunity for students to gain hands-on experience in the field of accounting and auditing. By focusing on the practical training, students will be better prepared to start their careers as chartered accountants.

Here are some of the benefits of the new scheme:

- Students can focus on practical training and not have to worry about exam preparation.

- Students will be better prepared to start their careers as chartered accountants.

- Students will have more time to explore different career options.

3. The Institute of Chartered Accountants of India (ICAI) has announced a 100% increase in the stipend for CA articleship students. This means that the stipend will be doubled from the current level.

The increase in the stipend is a welcome move for CA articleship students. It will help to offset the rising cost of living and make it easier for students to support themselves while they are completing their articleship training.

The ICAI has said that the increase in the stipend is in line with its commitment to providing a fair and equitable training experience for all CA articleship students.

Here are some of the benefits of the increase in the stipend:

- The proposed scheme is designed to mitigate the impact of increasing living expenses.

- It will make it easier for students to support themselves while they are completing their articleship training.

- It will help to attract more students to the CA profession.

4. The Institute of Chartered Accountants of India (ICAI) has reduced the number of leaves that articleship students can take. Previously, students could take up to 180 days of leave during their articleship training. However, under the new scheme, students can only take up to 12 days of leave in a year. This means that students can take a maximum of 24 days of leave during their entire articleship training.

The reduction in the number of leaves is due to the fact that students no longer have to give any exams during their articleship training. In the past, students would often take leaves to prepare for exams. However, with the new scheme, students will be able to focus on their practical training without having to worry about exams.

The reduction in the number of leaves is a controversial move. Some people believe that it is unfair to students, as they will have less flexibility during their articleship training. However, others believe that the reduction in the number of leaves is necessary, as it will ensure that students are able to complete their practical training on time.

Here are some of the pros and cons of the reduction in the number of leaves:

Pros:

- It will ensure that students are able to complete their practical training on time.

- It will free up more time for students to focus on their practical training.

- It will help to reduce the cost of articleship training for students.

Pros:

- It will reduce the flexibility of students during their articleship training.

- It may make it more difficult for students to take care of personal or family matters.

- It may make it more difficult for students to prepare for the CA Final exams.

Ultimately, the decision of whether or not to reduce the number of leaves is a complex one. There are both pros and cons to the move, and it is important to weigh these factors carefully before making a decision.

Changes to the Final course

1. To become eligible to register for the CA Final course, students must pass both groups of CA Intermediate exams and complete the ICITSS training. However, to appear in the CA Final exams, students must also complete the following:

- Complete the Advanced ICITISS Course: This is a mandatory course that covers topics such as data analytics, information security, and financial management.

- Complete a 6-month study period:This is a period of time during which students can focus on their studies and prepare for the CA Final exams.

- Crack all 4 self-paced modules:These modules cover the core subjects of the CA Final exams.

The CA Final registration is valid for 10 years. Aspirants can revalidate their registration after 10 years with the prescribed fee.

Here is a table that summarizes the requirements for appearing in the CA Final exams:

| Requirement | Description |

|---|---|

| Pass both groups of CA Intermediate exams | Students must score a minimum of 50% in each paper in order to pass the CA Intermediate exams. |

| Complete the ICITSS training | This is a mandatory course that covers topics such as data analytics, information security, and financial management. |

| Complete the Advanced ICITISS Course | This is a mandatory course that covers topics such as data analytics, information security, and financial management. |

| Complete a 6-month study period | This is a period of time during which students can focus on their studies and prepare for the CA Final exams. |

| Crack all 4 self-paced modules | These modules cover the core subjects of the CA Final exams. |

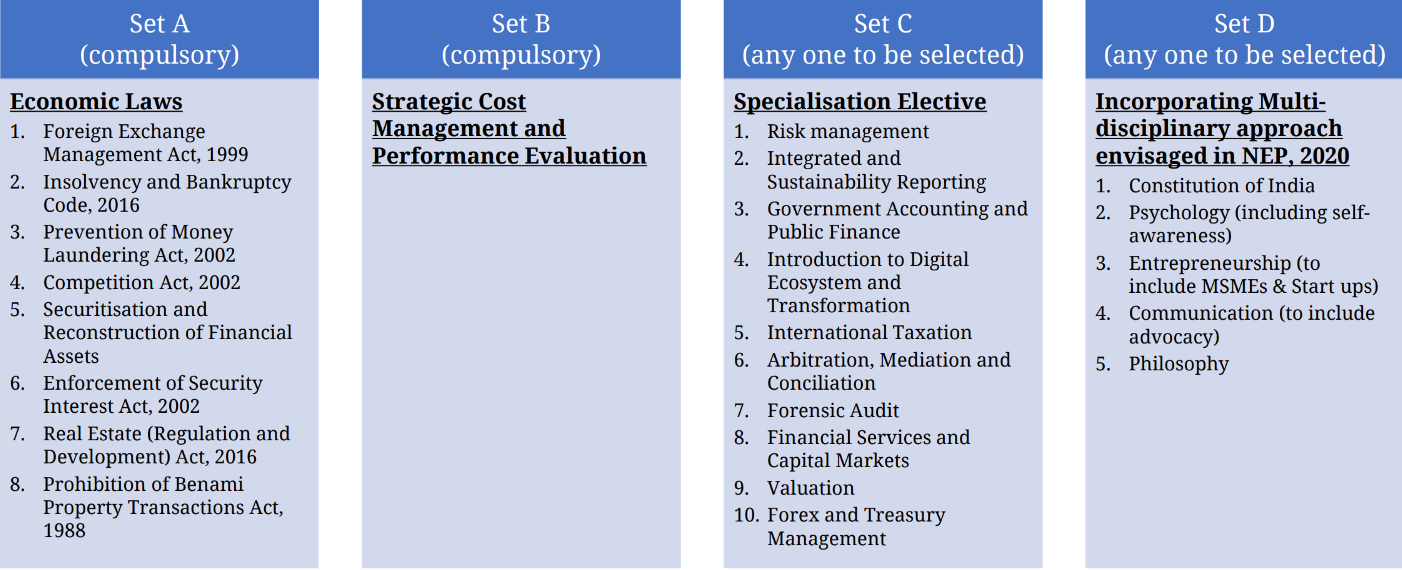

2. The Institute of Chartered Accountants of India (ICAI) has announced a major overhaul of the CA Final exams. Under the new scheme, which will be proposed from 2023, the number of papers will be reduced from 8 to 6. The exams will be divided into two groups, each with 3 papers.

The major changes to the CA Final subjects are as follows:

- Papers 4 and 5 will be removed and included in the self-paced modules.These papers covered the topics of Information Technology and Strategic Management.

- Paper 6 will now be a compulsory paper on multi-disciplinary case study with Strategic Management.This paper will assess students' ability to apply their knowledge of accounting, auditing, and taxation to real-world business problems.

- Elective subjects such as risk management, financial services, and capital markets will now be part of the Set C of the self-paced modules.These subjects will be offered as optional modules that students can choose to study.

The changes to the CA Final exams are designed to make the exams more relevant to the needs of the modern workplace. The new syllabus will focus on the core competencies that chartered accountants need to succeed in today's business environment.

The new scheme is a positive development for CA aspirants. It will make the CA Final exams more manageable and it will also allow students to focus on the subjects that are most relevant to their career goals.

Here is a table that summarizes the changes to the CA Final subjects:

| Old Paper | New Paper | Description |

|---|---|---|

| Paper 4 | Self-paced module | Information Technology |

| Paper 5 | Self-paced module | Strategic Management |

| Paper 6 | Multi-disciplinary case study with Strategic Management | Compulsory paper |

| Elective subjects | Set C of self-paced modules | Optional modules |

There will be a negative marking of 25% for every wrong MCQ answer. This means that for every wrong MCQ answer, students will lose ¼ of the marks for that question.

The CA Final exemption rules are the same as the CA Intermediate exemption rules. This means that students can be exempted from appearing in the CA Final exams if they have passed the CA Intermediate exams with a minimum of 60% in each paper.

Here is a table that summarizes the CA Final assessment system:

| Assessment type | Percentage of questions | Negative marking |

|---|---|---|

| MCQs | 30% | 25% |

| Descriptive questions | 70% | No negative marking |

Changes to Exit route

The Institute of Chartered Accountants of India (ICAI) has introduced a new exit route for the CA Course 2023. This exit route is designed to provide students with an alternative to the CA Final exams.

Under the new exit route, students who have cleared both groups of CA Intermediate, completed the CA Articleship Training, and completed the soft skills and Information technology courses will be eligible to receive the certificate of Business Accounting Associate.

To be eligible for the certificate of Business Accounting Associate, students must also complete all 4 self-paced modules. These modules cover the core subjects of the CA Final exams.

The certificate of Business Accounting Associate is a valuable credential that will demonstrate to employers that students have the skills and knowledge necessary to succeed in the business world.

Here are some of the benefits of the new exit route:

- It will provide students with an alternative to the CA Final exams.

- It will demonstrate to employers that students have the skills and knowledge necessary to succeed in the business world.

- It will allow students to enter the workforce sooner

ICAI self-paced modules

The Institute of Chartered Accountants of India (ICAI) has introduced self-paced modules as part of its new CA Course. These modules are designed to provide students with an opportunity to learn the core subjects of the CA Final exams at their own pace.

There are four self-paced modules in total, covering the following subjects:

- Information Technology

- Strategic Management

- Multi-disciplinary case study with Strategic Management

- Elective subjects

The modules are interactive and engaging, and they include a variety of learning resources, such as video lectures, case studies, and quizzes.

To be eligible to appear in the CA Final exams, students must complete all four self-paced modules.

The self-paced modules are a valuable resource for students who are preparing for the CA Final exams. They provide students with an opportunity to learn the core subjects at their own pace and in a way that is tailored to their individual learning style.

Here are some of the benefits of the self-paced modules:

- They provide students with an opportunity to learn the core subjects at their own pace.

- They are interactive and engaging, which can help students to retain the information that they learn.

- They include a variety of learning resources, which can help students to learn in a way that is tailored to their individual learning style.

- They are a valuable resource for students who are preparing for the CA Final exams.

Conclusion

The Institute of Chartered Accountants of India (ICAI) has introduced a new education system for the CA Course 2023. The new system is designed to make the CA Course more relevant to the needs of the modern workplace and to provide students with a more flexible and engaging learning experience.

The key changes to the CA Course 2023 include:

- A reduction in the number of papers from 8 to 6. The introduction of self-paced modules for the core subjects of the CA Final exams.

- A new exit route for students who do not wish to pursue the CA Final exams.

- A new system of assessment for the CA Final exams, with 30% MCQ-based questions and 70% descriptive questions.

The new education system is a positive development for CA aspirants. It will make the CA Course more manageable and it will also allow students to focus on the subjects that are most relevant to their career goals.

The new system is still in its early stages, and it will be interesting to see how it is proposed and how it affects the CA Course in the years to come. However, the changes that have been made so far are a step in the right direction, and they could make the CA Course a more attractive option for students who are looking for a challenging and rewarding career in accounting.

Here are some of the benefits of the new education system:

- It will make the CA Course more relevant to the needs of the modern workplace.

- It will provide students with a more flexible and engaging learning experience.

- It will allow students to focus on the subjects that are most relevant to their career goals.

- It could make the CA Course a more attractive option for students.

Overall, the new education system is a positive development for CA aspirants. It is still in its early stages, but it has the potential to make the CA Course a more relevant, flexible, and engaging learning experience.

Here is the pdf mentioning details about the new scheme.

Are you determined to conquer the challenges of the new scheme for CA exam and achieve your dream of becoming a Chartered Accountant? Don't leave your success to chance – enrol in our CA coaching program today and pave the way to a triumphant CA journey!

At SPC, we understand the demands and intricacies of the CA exam like no other. Our expert faculty, renowned for their deep subject knowledge and teaching prowess, will guide you through the entire CA syllabus, ensuring you grasp every concept with clarity and precision.

By joining our CA coaching program, you will gain access to comprehensive study materials, mock exams, and personalized guidance tailored to your individual needs. Our proven teaching methodologies and exam-oriented approach will sharpen your skills, enhance your problem-solving abilities, and boost your confidence, equipping you to tackle the CA exam with unwavering determination.

Seize this opportunity to unlock your full potential and increase your chances of clearing the CA exam on your first attempt. Join our esteemed CA coaching program and embark on a transformative learning journey that will set you apart from the competition.

Don't let anything hold you back from achieving your CA goals. Take action now and enrol in our CA classes. Your CA success story begins here!